How Do You Know if Company Information Is Confidential

Do you lot need potent writing skills to succeed in finance?

Not necessarily, just they certainly help.

But you definitely need strong reading comprehension skills, or you'll miss crucial data and make the incorrect decisions as a result.

Both of these skills intersect in the confidential information memorandum (CIM) that investment banks prepare for clients – the same CIM that you'll exist spending a lot of fourth dimension reading in private disinterestedness, corporate development, and other buy-side roles.

There is surprisingly little information out there on what goes into a CIM, and there'southward a lot of confusion over how y'all write one and how y'all read and interpret a CIM.

So here's the full run-downward, from how they are used in investment banking to private equity and across – along with a bunch of real-life CIMs:

What is a CIM?

The Confidential Information Memorandum is part of the sell-side M&A procedure at investment banks. It's also known every bit the Offering Memorandum (OM) and Information Memorandum (IM), amidst other names.

At the beginning of any sell-side Yard&A process, y'all'll gather information on your client (the visitor that has hired you to sell it), including its products and services, financials, and market.

You turn this information into many documents, including a shorter, 5-10 folio "Executive Summary" or "Teaser," then a more in-depth, fifty+ folio "Confidential Information Memorandum."

You start by sending the Teaser to potential buyers; if someone expresses involvement, y'all'll have the business firm sign an NDA, and then you'll ship more detailed information nigh your customer, including the CIM.

You can write CIMs for debt deals, every bit well as for distressed M&A and restructuring deals where your depository financial institution is advising the debtor.

You might write a brusque memo for equity deals, but not an unabridged CIM.

The Gild and Contents of a Confidential Data Memorandum

The structure of a CIM varies by house and grouping, but it usually contains these sections:

1) Overview and Key Investment Highlights

2) Products and Services

three) Market

four) Sales & Marketing

5) Management Team

half dozen) Financial Results and Projections

7) Gamble Factors (Sometimes omitted)

viii) Appendices

Debt-related CIMs volition include the proposed terms – involvement rates, interest rate floors, maturity, covenants, etc. – and details on how the visitor plans to use the funding.

What a Confidential Data Memorandum is Not

First and foremost, a CIM is Non a legally binding contract.

It is a marketing document intended to make a visitor look as shiny as possible.

Bankers apply copious makeup to companies, and they can make fifty-fifty the ugliest duckling wait like a perfectly shaped swan.

But it's up to you to go beneath the dress and run across what it looks like without the makeup and the plastic surgery.

2nd, in that location is also null on valuation in the CIM.

Investment banks don't want to "gear up the price" at this stage of the procedure – they would rather let potential buyers identify bids and see where they come in.

Finally, a CIM is NOT a pitch book. Here's the difference:

Pitch Book : "Hey, if you lot hire united states of america to sell your visitor, nosotros could get a great price for yous!"

CIM: "You lot've hired the states. Nosotros're now in the procedure of selling your company. Here'southward how we're pitching information technology to potential buyers and getting you a proficient price."

Why Do CIMs Thing in Investment Banking?

You lot will spend a lot of time writing CIMs as an annotator or acquaintance in investment banking.

And in buy-side roles, you will spend a lot of time reading CIMs and deciding which opportunities are worth pursuing.

People similar to obsess over modeling skills and technical wizardry, but in most finance roles you spend FAR more time on administrative tasks such as writing CIMs (or reading and interpreting CIMs).

In investment banking, you lot might outset marketing your client without creating a circuitous model first (Why bother if no one wants to buy the company?).

And in buy-side roles, y'all might expect at thousands of potential deals but decline 99% of them early because they don't encounter your investment criteria, or because the math doesn't work.

You spend a lot of fourth dimension reviewing documents and comparatively less time on in-depth modeling until the deal advances quite far.

So yous must be familiar with CIMs if your job involves pitching or evaluating deals.

Show Me the Confidential Information Memorandum Case!

To give y'all a sense of what a CIM looks like, I'm sharing half-dozen (6) samples, along with a CIM template and checklist:

- Consolidated Utility Services – Sell-Side K&A Deal

- American Casino – Sell-Side M&A Deal

- BarWash (Fake company) – Sell-Side One thousand&A Deal

- Alcatel-Clear-cut – Debt Deal

- Arion Banki hf (Icelandic bank) – Debt Deal

- Pizza Hut – Debt Bargain

- Sample Deal – CIM Template

- Information Memorandum Checklist

To find more examples, Google "confidential information memorandum" or "offering memorandum" or "CIM" plus the company name, industry proper name, or geography you are seeking.

Picking an Example CIM to Analyze

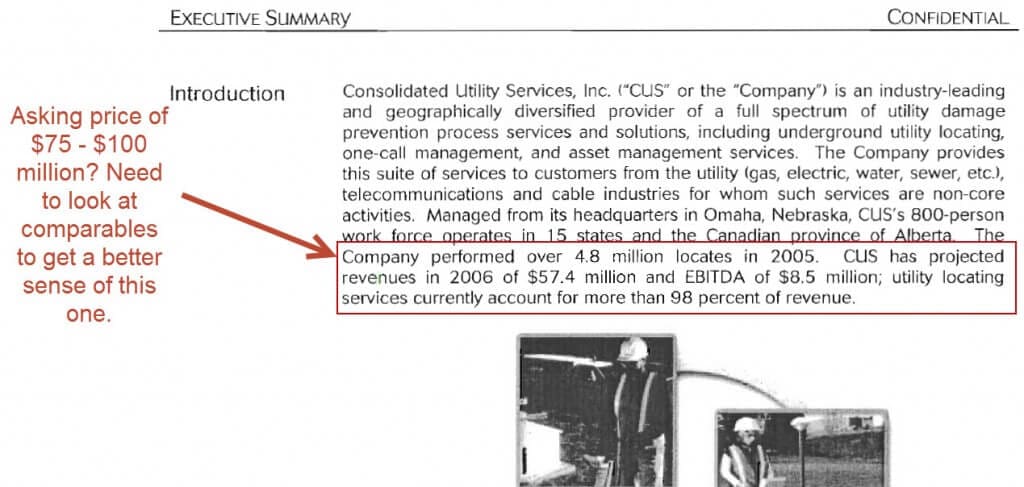

To illustrate how you might write a CIM as a broker and how you might interpret a CIM in buy-side roles, permit's have a look at the one in a higher place for Consolidated Utility Services (CUS).

This one has the standard sections, though it omits the Risk Factors and Appendices, resulting in a somewhat shorter (!) length of 58 pages.

This CIM is ancient, so I feel comfortable sharing it and explaining how I would evaluate the company.

CIM Investment Banking: How Exercise Y'all Create Them?

This CIM creation procedure is quite dull for bankers because information technology consists of a lot of copying and pasting from other sources.

Y'all'll spend 90% of your "thinking time" on but two sections: the Executive Summary / Investment Highlights in the starting time and the Financial Performance function toward the end.

You lot may do boosted research on the manufacture and the company's competitors, merely you lot'll get much of this information from your client; if you're working at a large bank, you can besides inquire someone to pull upwards IDC or Gartner reports.

Similarly, y'all won't write much original content on the company'southward products and services or its management team: you get these details from other sources and then tweak them in your document.

The Executive Summary section takes fourth dimension and energy because you need to retrieve nearly how to position the company to potential buyers.

You attempt to demonstrate the following points:

- The visitor'southward best days lie ahead of information technology. At that place are potent growth opportunities, plenty of ways to ameliorate the business organisation, and right now is the best time to learn the company.

- The visitor'due south sales are growing at a reasonable clip (an average annual growth rate of at to the lowest degree five-x%), its EBITDA margins are decent (ten-20%), and it has relatively low CapEx and Working Capital requirements, resulting in substantial Free Greenbacks Flow generation and EBITDA to FCF conversion.

- The company is a leader in a fast-growing marketplace and has articulate advantages over its competitors. There are high switching costs, network furnishings, or other "moat" factors that make the company's business organisation defensible.

- Information technology has an experienced management team that can sail the send through stormy waters and turn things around earlier an iceberg strikes.

- There are merely modest risks associated with the visitor – a diversified customer base, high recurring revenue, long-term contracts, then on, all demonstrate this point.

If you turn to "Transaction Considerations" on page 10, yous can see these points in action:

"Summit-Performing, Geographically Diverse Manufacture Leader" means "less risk" – hopefully.

Then the bank lists the industry's attractive growth rates, the visitor'southward blue-chip customers (fifty-fifty lower risk), and its growth opportunities, all in pursuit of the five points above.

The "Fiscal Performance" Department of the CIM

The "Financial Performance" section as well takes up a lot of time because you lot have to "clothes up" a visitor'southward financial statements… without outright lying.

And so information technology's not equally like shooting fish in a barrel as pasting in the visitor's historical fiscal statements and so making simple projections – call up "reasonable spin."

Here are a few examples of "spin" in this CIM:

-

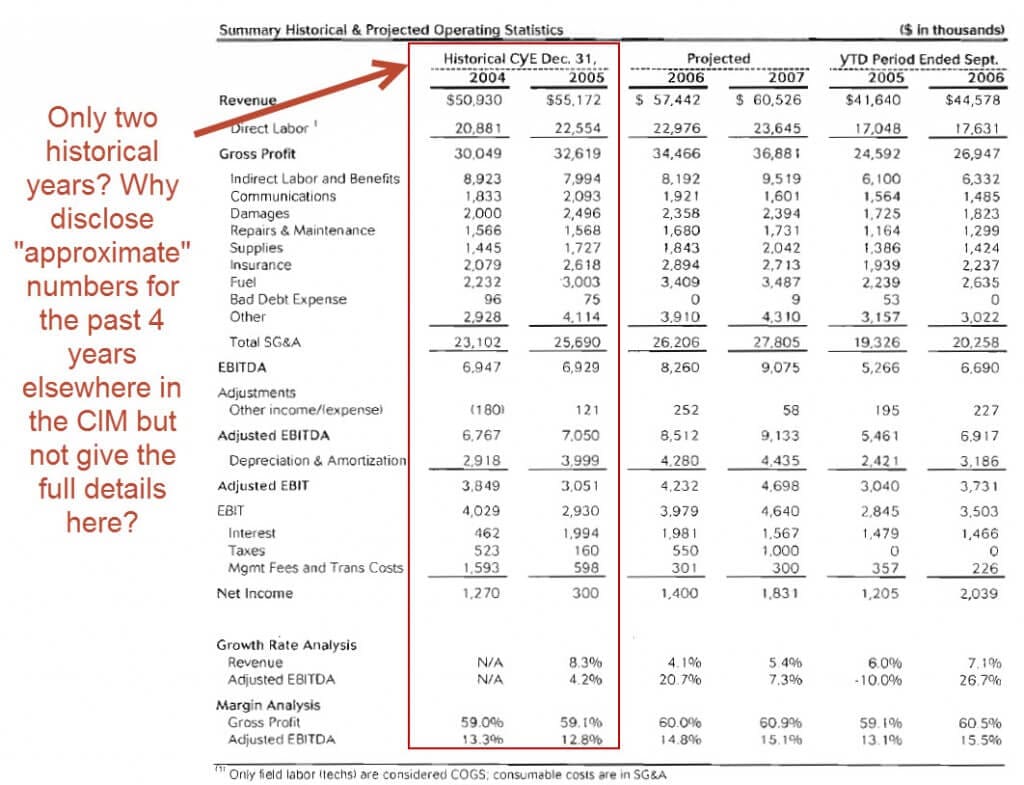

- Simply Two Years of Historical Statements – You lot normally similar to run across at to the lowest degree 3-5 years' worth of performance, and then perhaps the bankers showed merely ii years because the growth rates or margins were lower in the by, or because of acquisitions or divestitures.

- Recurring Revenue / Contract Spin – The bankers repeatedly point to the high renewal rates, but if you look at the details, you lot'll meet that a good percentage of these contracts were won via "competitive bidding processes," i.due east. the acquirement was by no means locked in. They also spin the lost customers in a positive way by claiming that many of those lost accounts were unprofitable.

- Flat EBITDA and Adjusted EBITDA Spin – EBITDA stayed the same at $half-dozen.9 1000000 in the past two historical years, only the bankers spin this by saying that it remained "stable" despite significantly college fuel costs… glossing over the fact that revenue increased past 8%. Figures like "Adjusted EBITDA" also lend themselves to spin since the adjustments are discretionary and are chosen to make a visitor look better.

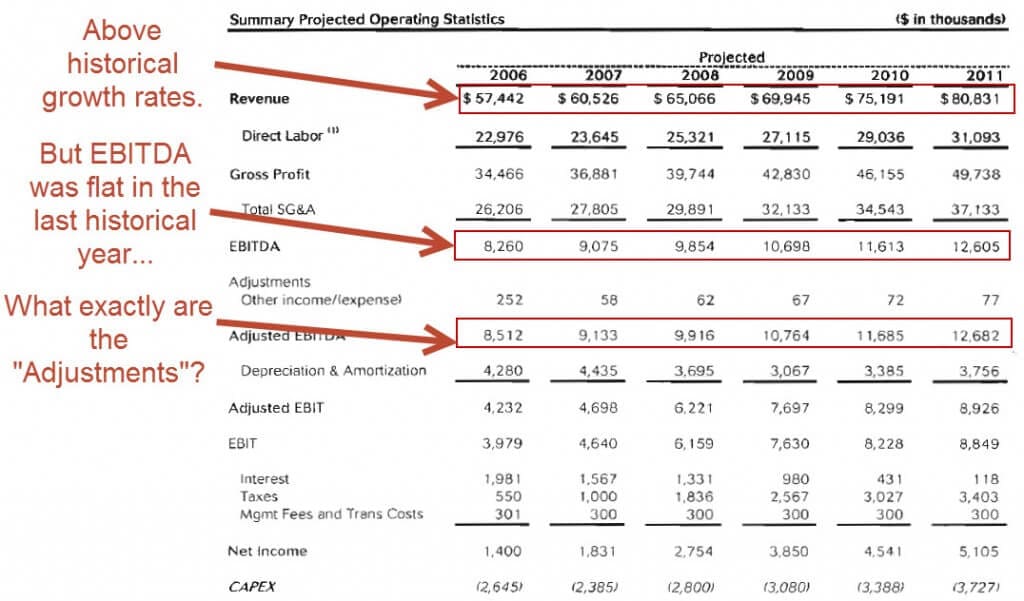

- Highly Optimistic Projected Financials – They're expecting acquirement to grow by 7.5% each year, and EBITDA to increase from $8.three million to $12.six million over the next five years – despite no EBITDA growth in the last historical year.

As a broker, your task is to create this spin and portray the company favorably without going overboard.

Does Any of This Make a Difference?

Yes and no.

Buyers will e'er do their due diligence and confirm or refute everything in the CIM before acquiring the company.

But the way bankers position the visitor makes a divergence in terms of which buyers are interested and how far they accelerate in the process.

Just as with M&A deals, bankers tend to add more value in unusual situations – divestitures, distressed/turnaround deals, sales of family unit-endemic individual businesses, and so on.

Example: In a sell-side divestiture bargain, the subsidiary being sold is always dependent on the parent visitor to some extent.

But in the CIM, bankers have to accept care with how they depict the subsidiary.

If they say, "Information technology could easily stand on its own, no problem!" then more private equity buyers might evidence an interest in the deal and submit bids.

But if the PE firms discover out that the bankers were exaggerating, they might drop out of the process very quickly.

On the other mitt, if the bankers say that it will take significant resources to plough the subsidiary into an independent visitor, the bargain might never happen due to a lack of interest from potential buyers.

So it's a careful balancing act between hyping up the company and admitting its flaws.

How Do You Read and Interpret the Confidential Information Memorandum in Private Disinterestedness and Other Buy-Side Roles?

Y'all volition receive A LOT of CIMs in nearly individual equity roles, especially at middle-marketplace and smaller funds.

And then y'all demand a fashion to skim them and brand a conclusion in x-xv minutes about whether to reject the visitor upfront or keep reading.

I would recommend these steps:

- Read the beginning few pages of the Executive Summary to larn what the company does, how big it is in terms of sales, EBITDA, greenbacks flow, etc., and understand its manufacture. You might exist able to reject the company correct abroad if it doesn't run into your investment criteria.

- So, skip to the financials at the end. Look at the company's revenue growth, EBITDA margins, CapEx and Working Capital requirements, and how closely FCF tracks with EBITDA. The financial projections tend to exist highly optimistic, so if the math doesn't piece of work with these numbers, chances are information technology volition never piece of work in real life.

- If the bargain math seems plausible, skip to the market/industry overview section and look at the manufacture growth rates, the visitor'southward competitors, and what this company'southward USP (unique selling proposition) Why practice customers selection this visitor over competitors? Does it compete on service, features, specializations, price, or something else?

- If everything so far has checked out, then you can start reading about the management team, the customer base, the suppliers, and the actual products and services. If y'all get in to this step, you might spend anywhere from one hour to several hours reading those sections of the CIM.

Applying the Assay in Real Life

Here's you might employ these steps to this memo for a quick analysis of CUS:

First Few Pages: It's a utility services company with around $57 meg in revenue and $9 million in EBITDA; the request price is likely betwixt $75 meg and $100 million with those stats, though you'd demand to look at comparable company assay to be certain.

There has been solid acquirement and EBITDA growth historically, only the company was formed via a combination of smaller companies so it's difficult to divide organic vs. inorganic growth.

At this bespeak, you might be able to pass up the visitor based on your firm's investment criteria: for example, if you only look at companies with at least $100 one thousand thousand in revenue, or you lot practise not invest in the services sector, or you exercise not invest in "whorl-ups," you would end reading the CIM.

There are no real red flags even so, but information technology does seem like customers are price-sensitive ("…price is generally i of the almost important factors to the client"), which tends to be a negative sign.

Financials at the End: Y'all tin skip to folio 58 at present because if the deal math doesn't work with direction'due south highly optimistic numbers, information technology definitely won't work with realistic numbers.

Permit's say your fund targets a 5-twelvemonth IRR of twenty% and expects to apply a 5x leverage ratio for deals in this size range.

The visitor is already levered at ~2x Debt / EBITDA, then you can only add 3x Debt / EBITDA.

If you do the crude math for this scenario and presume a $75 1000000 purchase price:

A $75 one thousand thousand purchase enterprise value represents a ~9x EV / EBITDA multiple, with 3x of additional debt and 2x for existing debt, which implies an equity contribution of 4x EBITDA (~$33 meg).

If you re-sell the company in five years for the aforementioned 9x EBITDA multiple, that's an Enterprise Value of ~$113 meg (9x * $12.six one thousand thousand)… simply how much debt will need to be repaid at that point?

To reply that, we need the company's Free Cash Flow projections… which are not shown anywhere.

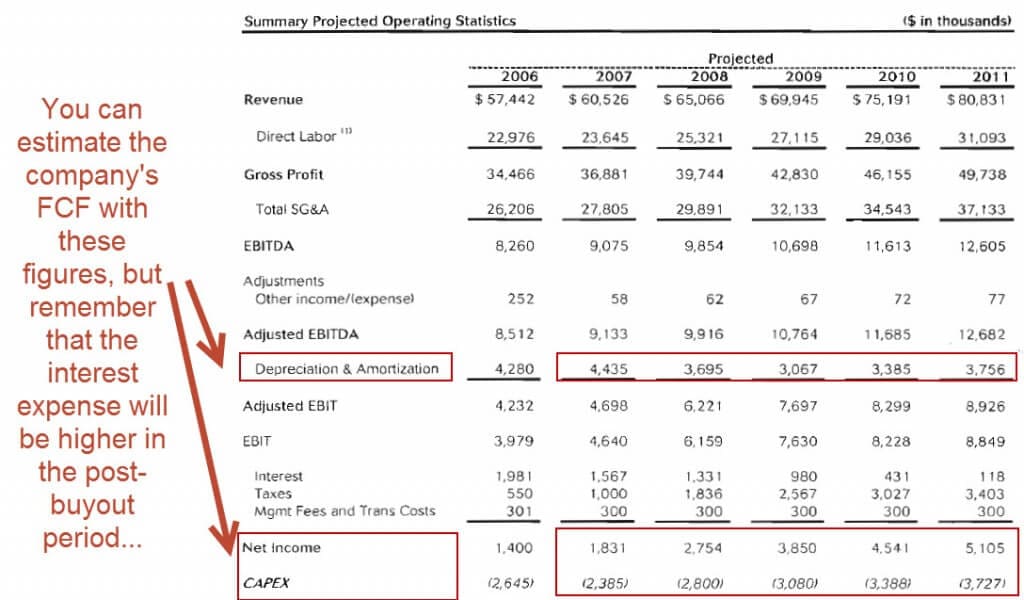

Nonetheless, nosotros tin can guess its Free Greenbacks Menses with Cyberspace Income + D&A – CapEx and so assume the working majuscule requirements are low (i.e., that the Modify in Working Capital every bit a percentage of the Change in Revenue is relatively low).

If you do that, yous'll get figures of $three.nine, $three.6, $iii.viii, $four.5, and $5.1 meg from 2007 through 2011, which adds up to $21 one thousand thousand of cumulative FCF.

But think that the involvement expense will be significantly higher with 5x leverage rather than 2x leverage, and then we should probably reduce the sum of the cumulative FCFs to $ten-$15 1000000 to business relationship for that.

Initially, the visitor will have effectually $42 1000000 in debt.

By Year five, it will have repaid $ten-15 meg of that debt with its cumulative FCF generation. We'll split the difference and call it $12.5 meg.

At a 9x EV / EBITDA exit multiple, the PE firm gets proceeds of $113 meg – ($42 1000000 – $12.v million), or ~$84 million, upon exit, which equates to a five-year IRR of 20% and a 2.5x cash-on-cash multiple.

I would reject the company at this point.

Why?

- Even with optimistic assumptions – the same EBITDA exit multiple and revenue and EBITDA growth above historical numbers – the IRR looks to be around xx%, which is only barely within your business firm'southward desired range. And with a lower exit multiple or more moderate growth, the IRR drops below 20%.

- The EBITDA growth looks fine, just FCF generation is weak due to the company's relatively loftier CapEx, which limits debt repayment capacity.

- Information technology seems similar the company doesn't have much pricing power, since quite a few contracts were renewed via a "competitive bid bike process." Low pricing power means it will be harder to maintain or improve margins.

On the other mitt, you might expect at this certificate and translate it completely differently.

The numbers don't seem spectacular for a standalone investment, but this company could correspond an excellent "roll-up" opportunity because there are tons of smaller companies offering similar utility services in different regions (see "Pursue Additional Add-on Acquisitions" on page xiv) (for more, run across our tutorial to bolt-on acquisitions).

So if your firm focuses on roll-ups, and so perhaps this deal would look more compelling.

And so you would read the residuum of the confidential information memorandum, including the sections on the industry, competitors, management team, and more than.

You would as well do a lot of research on how many smaller competitors could be acquired, and how much it would cost to exercise so.

What Adjacent?

These examples should give yous a flavor of what to expect when you write a confidential data memorandum in investment banking, or when you read and interpret CIMs in private equity.

I'm not going to say, "Now write a 100-page CIM for practice!" because I don't recall such an practise is helpful – at least, not unless you lot want to practice the Ctrl + C and Ctrl + V commands.

So hither'southward what I'll recommend instead:

- Pick an example CIM from the list above, or Google your style into a CIM for a unlike company.

- And so, look at the Executive Summary and Financial Performance sections and find the 5-10 central areas where the bankers accept "dressed upwards the company" and spun information technology in a positive light.

- Finally, pretend you're at a private disinterestedness business firm and follow the decision-making procedure I outlined above. Take 20 minutes to scan the document and either reject the visitor or keep reading the CIM.

Bonus points if you can locate typos, grammatical errors, or other attention-to-detail failures in the memo you choice.

Any questions?

Source: https://www.mergersandinquisitions.com/confidential-information-memorandum/

Post a Comment for "How Do You Know if Company Information Is Confidential"